The Greenbacks

Lincoln felt the weight of the world upon his shoulders after he was elected President. Before he assumed office he saw himself facing the greatest crisis since the Revolutionary War. He even called the situation his own Garden of Gethsemane and prayed that the burden of dealing with it could be lifted.

Little did he know at the time that the physical enemies that loomed before him were less than half the problem. The greater half of the war he faced was discovered shortly after he became president and the problem was clearly seen near his death in 1865 when he said this in a statement to Congress:

“The money powers prey upon the nation in times of peace and conspire against it in times of adversity. The banking powers are more despotic than a monarchy, more insolent than autocracy, more selfish than bureaucracy. They denounce as public enemies all who question their methods or throw light upon their crimes. I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at my rear is my greatest foe.”

Nov. 21, 1864 (letter to Col. William F. Elkins) The Lincoln Encyclopedia, Archer H. Shaw (Macmillan, 1950, NY

Lincoln first received a taste of this first enemy at the beginning of the war when he realized that they would have to amass an enormous sum of money if they were to defeat the South. The problem for both sides is that neither had the supplies of gold and silver coin necessary to wage much of a challenge. It seemed that whoever could borrow the most money would prevail.

As Lincoln and his cabinet checked out the possibility of borrowing from banks within the country they soon found that they were of little use. Over 1600 private banks existed and each of their 7000 notes had different values and confidence of the people. But the real problem became obvious when Lincoln discovered that they wanted over 20% interest on any loans they made to a government that may not be there tomorrow if the South were to prevail.

The eastern banks were particularly outrageous as they offered Lincoln a $150 million loan package at rates between 24-36%.

Lincoln felt there must be a better way to finance the war than making the winners slaves to the banks. This was irony indeed considering the war was said to end slavery.

There had to be a better way to finance the war so the President listened to all possible suggestions from his cabinet, Congress and consultants.

There was only about $100 million in gold and silver in the whole country and about 25 times that amount would be needed by the North alone to consummate the war. Secretary Chase supported the idea of issuing government war bonds. There were about $2 billion worth of these issued during the war usually at 6% interest.

As the war continued it became obvious that the bonds would not fulfill all the financial needs and the Greenback made its appearance to supply additional financing. Some say that Congress acted on its own initiative to pass legislation to create the Greenbacks and others call Lincoln’s friend, Dick Taylor the “Father of the Greenback” for selling he idea to the President.

The story relates that Lincoln called on Taylor for advice on financing the war and when meeting they he said:

“Why, Lincoln,” Taylor is said to have replied, “that is easy; just get Congress to pass a bill authorizing the printing of full legal tender treasury notes or greenbacks, and pay your soldiers with them and go ahead and win your war with them also.”

“Do you suppose the people will take them?” Lincoln is said to have asked.

And to this Taylor replied, “The people or anyone else will not have any choice in the matter, if you make them full legal tender. They will have the full sanction of the government and be just as good as any money; as Congress is given that express right by the Constitution and the stamp of full legal tender by the Government is the thing that makes money good anytime, and this will always be as good as any other money inside the borders of our country.”

Lincoln also had an economic adviser named Henry Carey who was a big supporter of the Greenback idea and it is thought that he also had a strong influence on Lincoln.

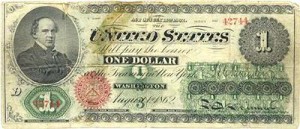

Some claim Lincoln then worked with Congress to pass the Greenback legislation and other historians believe Congress passed it independent of the President. Congressman E. G. Spaulding from New York was a big promoter of Greenback legislation. It seemed that the Greenback was an idea whose time had come. Legislation was passed on Feb 25, 1862 and Lincoln signed it into law. At first $150 million was authorized with a total of $450 million being put into circulation as the war continued.

The Lincoln administration partially bypassed the bankers with the war bonds, but the Greenbacks left them completely out of the loop. This was pure fiat money from the government that created no debt whatsoever and there was no interest to be paid to bankers or anyone else.

As word of the Greenbacks reached the big bankers in England and Europe great alarm was felt. In 1865 The London times wrote:

“If that mischievous financial policy, which had its origin in the North American Republic, should become indurate down to a fixture, then that government will furnish its own money without cost. It will pay off debts and be without a debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in the history of civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed or it will destroy every monarchy on the globe.”

The Greenbacks had several advantages over the fiat Continental currency in that they were very difficult to counterfeit. They used a proprietary green chromium tint invented by Canadian Dr. Sterry Hunt to combat photo duplication. This made the Greenbacks very difficult to counterfeit. The bills got their name from this “green” ink on the “back” of the bill. The name did not come from the Lincoln administration but from the common people who started calling them “Greenbacks.”

It is interesting that the two men with the greatest authority (Lincoln and Chase) had strong reservations about the Greenback. Chase was particularly negative and may have influenced Lincoln at first. After Lincoln’s death Chase supported the retirement of the Greenback.

Fortunately Lincoln saw that the greenback was necessary and supported legislation to create them. As time passed he seemed to have embraced them as he said: “… (We) gave the people of this Republic the greatest blessing they have ever had – their own paper money to pay their own debts…”

Quote from Who Rules America by C. K. Howe

Near the end of his life Lincoln expressed interest in printing more Greenbacks. Some believe that his association with the Greenbacks, as seen through the eyes of the bankers, was part of the reason he was killed. Many students believe that his lack of cooperation with powerful bankers created a conspiracy against him. Whatever the case, it is obvious that many bankers were happy to have him out of the way thanks to John Wilkes Booth.

Those who do not like fiat money and/or the Greenback attack it as being inflationary and not holding its value. Most of the Greenback attacks I have read point out that it reached a low of 36 cents against what started as a dollar’s worth of gold. They rattle this off and then dismiss the Greenback out of hand as being “toilet paper money,” or worthless.

This is an extremely deceptive and mean spirited affront on truth and logic and leaves out the whole picture. Let us therefore fill in the blanks so the reader can make an informed judgment.

What readers are generally not told was that this low represented a spike that lasted less than a month. It was caused in part by a fear that the country would have a repeat of the inflation of the Continental currency. As soon as Congress let it be known that the total issue would not exceed $450 million the value of the Greenback sharply rose against gold. Here are the facts.

Congress authorized the circulation of Greenbacks on Feb 25, 1862. Their stated value was equal to one dollar in gold. They dropped down to 58 cents by the end of the year, but rose back up to 82 cents about six months later and then back down to the low of 36 cents on July 16, 1864. This low followed the largest release of Greenbacks during the war – $200 million and some were frightened that an unlimited inflationary amount was forthcoming.

Congress stated the total release would be limited to $450 million and put and end to this fear and it rose to 68 cents by December 1865. It rose steady after that until it became equal with gold in December 1878.

If the total issue of new money was limited to Greenbacks during the war the value of the Greenbacks would have held much higher, but often overlooked is the fact that almost $2 billion in war bonds, which was over four times the number of Greenbacks, was the major cause of the inflation of fiat money during the war.

It is interesting to note that this still does not tell the whole story. A small detail left out by the anti Greenback crowd is that the purchasing power of gold itself fluctuated significantly during the Greenback era.

Now some diehards will claim the value of gold never fluctuates giving their reasoning that an ounce of gold is always worth an ounce of gold. This thinking makes no sense and is like saying a Greenback is always worth a Greenback or a pound of wheat is always worth a pound of wheat. The hard fact is that every currency and commodity fluctuates in value and this includes gold as we illustrated a few pages back.

During the war conversion of notes into gold was suspended so this turned gold into a commodity with fluctuations like wheat or corn. The price of gold in relation to its value compared to commodities at the beginning of the greenback era fluctuated over 200% during the war. Cotton fluctuated much more though because of interrupted flow from the South. Its range of value was 1300%. In other words, it took a lot more gold to buy a pound of cotton near the end of the war than the beginning.

Wages also rose but not as much as the average commodity price or gold. When one takes all these fluctuations into account he must conclude that any indexed value of the Greenback would move like a roller coaster during such turbulent times no matter what happened to gold.

Stephen Zarlenga gives this interesting quote from Civil War historian J. G. Randall:

“The threat of inflation was more effectively curbed during the Civil War than during the First World War. Indeed as John K. Galbraith has observed, ‘it is remarkable that without rationing, price controls, or central banking, Chase could have managed the federal economy so well during the Civil War.”

He then adds this:

The fact that the Greenbacks were not accepted for import duties may also have been an important negative factor against the currency:“Hence it has been argued that the Greenback circulation issued in 1862 might have kept at par with gold if it, too, had been made receivable for all payments to the Government,” wrote financial historian (Davis Rich) Dewey.

When one considers the mountain of obstacles the Greenback had to surmount to hold on to any value it is amazing that it did not go the way of the Continental which was worth virtually zero at the war’s end.

Here is a partial list of what the Greenback had to overcome.

(1) Almost $2 billion worth of inflationary bonds thrown into circulation.

(2) A Secretary of Treasury that was against their existence.

(3) The fact that almost all the spending of the Greenbacks during the war was for the war itself which added no wealth to the economy. This would be similar to spending money on digging holes and then filling them up again. Nothing is added to wealth.

(4) The fluctuations of wholesale, commodity and labor prices during a fight for survival.

(5) Attacks by big bankers to undermine its value.

(6) Attacks by the Press attempting to bias the people against it.

(7) Counterfeiting attempts

(8) Being associated in the public mind with the Continental currency, which failed for reasons previously noted.

(9) A little known but potent problem the Greenbacks faced were religious fanatics of the time. Many Bible believers thought that gold was a God-sanctioned money and any move to create money not backed by it came straight from Satan. These people created quite a stir and turned many politicians against the Greenback after the war.

These preachers must not have read their Bible very carefully for it doesn’t really support their case. Yes, they used gold and silver as money or barter in Bible times but God didn’t seem to be thrilled with the idea. Take a look at these scriptures:

“Their idols are silver and gold, the work of men’s hands. They have mouths, but they speak not: eyes have they, but they see not: (Sounds like gold and silver coins)

“They have ears, but they hear not: noses have they, but they smell not:

…They that make them are like unto them; so is every one that trusteth in them.” Psalms 115:4-8

“Receive my instruction, and not silver; and knowledge rather than choice gold. For wisdom is better than rubies; and all the things that may be desired are not to be compared to it.” Proverbs 8:10-11

“He that loveth silver shall not be satisfied with silver.” Eccl 5:10

“They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the LORD: they shall not satisfy their souls, neither fill their bowels: because it is the stumblingblock of their iniquity.” Ezek 7:19

“Neither their silver nor their gold shall be able to deliver them in the day of the LORD’S wrath.” Zeph 1:18

It is amazing that the Greenback survived these problems and became a major factor in not only winning the war but inspiring people for a generation afterwards including the creation of a Greenback political party. Now finally, after its seeming demise, interest in the principle behind it is surfacing again.

The confederate currency didn’t fare so well as the Greenback.

In 1861 a confederate dollar was worth 90 cents in gold. By 1862 it had gone down to 83 cents and then took a big drop the next year to 29 cents. By 1864 it was worth only 5 cents and by early 1865 was on its way to oblivion at less than 2 cents in value.

The student of history may wonder why the Greenback held on to its value so much better. After all, they were the same type of money in similar circumstances, weren’t they?

Not quite.

There were several key differences. The first all important difference is that the Greenbacks were declared by fiat to be money, not a loan or promissory note, but national “legal tender for all debts public and private.”

The Confederate notes had no such fiat. Instead, they were promissory notes to be redeemed for something else of value in the future.

The second difference, which is also huge, is there was no limitation set on the number of Confederate notes that could be added to circulation. Whereas the Greenbacks were limited to $450 million the Confederates with no limitation wound up printing $1.55 billion in bills – over three times the amount of the Greenbacks in the North.

On top of this Lincoln took a queue from the British and counterfeited the Confederate dollar and circulated as many as possible in the South. Private counterfeiters also did their share. Their inflation became so bad that the South used Northern Greenbacks themselves to purchase essential goods and services. No one knows how many Confederate dollars were in circulation but judging from their inflation rate, it was several billion dollars worth.

Many students of monetary history believe the Greenback was the best money ever created. Its creation did not depend on bankers or loans and there was no interest to pay to anyone.

During the Greenback/Civil War era Ellen Brown says “the country managed to become the greatest industrial giant the world had ever seen. The steel industry was launched, a continental railroad system was created, the Department of Agriculture was established, a new era of farm machinery and cheap tools was promoted, a system of free higher education was established through the Land Grant College System, land development was encouraged by passage of a Homestead Act granting ownership privileges to settlers, major government support was provided to all branches of science, the Bureau of Mines was organized, governments in the Western territories were established, the judicial system was reorganized, labor productivity increased by 50 to 75 percent, and standardization and mass production was promoted worldwide.

“How was all this accomplished, with a Treasury that was completely broke and a Congress that hadn’t been paid themselves? As Benjamin Franklin might have said, “That is simple.” Lincoln tapped into the same cornerstone that had gotten the impoverished colonists through the American Revolution.”

Web of Debt by Ellen H. Brown, 2008, , Page 82

If we had created Greenbacks in our age rather than borrowing many trillions we would not be paying over $450 billion a year in interest. Instead, we could put that money to good use in keeping the nation solvent.

Maybe we will eventually learn our lesson.

Sources:

Web of Debt by Ellen H. Brown, 2008

The Lost Science of Money By Stephen Zarlenga

Patrick Carmack, Bill Still, The Money Masters: How International Bankers Gained Control of America (video, 1998), text at:

http://www.no-debts.com/anti-federalist/files/moneymasters.txt

Video at:

http://video.google.com/videoplay?docid=-515319560256183936#

The Lincoln Encyclopedia, Archer H. Shaw (Macmillan, 1950, NY

The Case for Gold by Ron Paul and Lewis Lehrman,

J. G. Randall, The Civil War and Reconstruction, edit. D. David, (Boston: Heath & Co, 1937, 2nd edition 1961)

Charles J. Bullock, Monetary History of the U.S., (New York: Macmillan, 1900)

Wesley Mitchell, Gold Prices and Wages Under the Greenback System, (Berkeley: Univ. Press, 1908)

Irwin Unger, The Greenback Era

(Princeton University Press, 1964)

A History of Money by Glyn Davies, 1994

- Read This entire series. Here are the links.

- The Economy – One Last Chapter

- Creating Sound Money

- The Gold Standard, Part 1

- The Gold Standard, Part 2

- The Gold Standard, Part 3

- The Gold Standard, Part 4

- The Gold Standard, Part 5

- The Gold Standard, Part 6

- The Gold Standard, Part 7

- The Fed and Common Sense

- Additional Points

- Alternative Currency

- Giving Away Our Power

- Parable of Money Systems

- To Fiat or Not Fiat

- Fiat Money of the Past, Part 1

- Fiat Money of the Past, Part 2

- Fiat Money of the Past, Part 3

- Fiat Money of the Past, Part 4

- Fiat Money of the Past, Part 5

- Fiat Money of the Past, Part 6

- Examining Fiat Money

- A Flawed Money System

- The Ideal Money

- A Time for All Things

- The New Greenback

- Narrowing the Focus

- People Taking Charge

- Creating Wealth

Copyright 2011 by J J Dewey

Copyright by J J Dewey

Index for Older Archives in the Process of Updating

Easy Access to All the Writings

For Free Book go HERE and other books HERE

JJ’s Amazon page HERE

Gather with JJ on Facebook HERE